What is Foxzard Indicator Builder?

Foxzard builder is an online tool that allows you to create your own indicators for the MetaTrader and TradingView platforms.

Combine common indicators into your own unique signal. No programming experience required. Sign up now and create your first signal in seconds.

Foxzard Paws Expert Advisor

Foxzard Paws EA is used to quickly open and close orders, modify stop loss and take profit by dragging lines on the chart. It also has a button to quickly take partial profit, move SL to breakeven and more...

Who can use it?

Foxzard is very easy for anyone to use. Start creating your own signal indicators now – absolutely no programming skills necessary.

All you need is some basic knowledge of common forex indicators and technical analysis.

Trailing and partial profit EAs

LOCTrailing with Partial Close expert advisor will automatically trail stop loss using one of ten trailing algorithms.

You can set a Breakeven Level and Partial Close function can be configured to close a part of the position after specified profit. More info...

Indicator builder features & functions

Features

- MetaTrader 4 (any version) compatible

- TradingView pine script compatible

- Indicator Source Code

- Signal provider for Foxzard Trader EA

- Unlimited number of conditions

- Independent conditions for buy and sell

Conditions

- Indicator lines cross

- Indicator line A is higher than indicator line B

- Indicator line changes direction

- Indicator reaches a static value

Indicators

- Moving Average (MA)

- Stochastic

- Moving Average Convergence Divergence (MACD)

- Commodity Channel Index (CCI)

- Relative Strength Index (RSI)

What is a signal indicator?

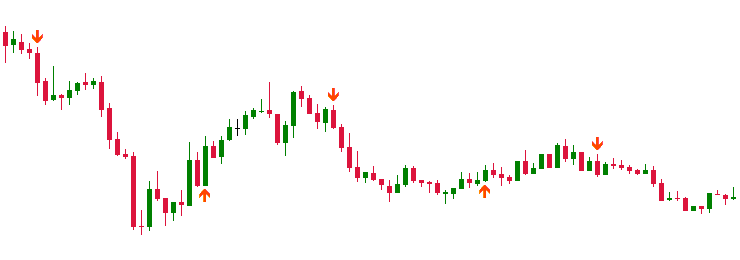

A signal indicator is normal MT4 / TradingView custom indicator that draws arrows on the chart when all conditions are met.

It can be used as a helper when trading manually or as a signal provider for Foxzard Trader EA and automated trading.

Is it profitable?

Foxzard enables you to create and test your own trading ideas and trading logic. Forex is an ever changing medium, so your indicators and signals must adapt to remain profitable.

With Foxzard you can tweak and test your trading rules to keep them profitable.